为什么富有之家财富很难超过三代?

为什么富有之家财富很难超过三代?

正文翻译

When you start dirt poor, making $10 an hour feels like a huge accomplishment. Likewise if you are born a middle-class kid, running your own profitable business could be a huge accomplishment. If you’re a businessman, you might want to run a huge corporate empire. If you run a huge corporate empire, you might then utilize your vast resources, join politics and even campaign for elections.

当你一贫如洗时,每小时挣10美元会让你感觉是一个巨大的成就。同样地,如果你出生在中产阶级家庭,经营自己的企业会让你感觉那是一项巨大的成就。如果你是一个商人,经营一个庞大的企业帝国是你的梦想。因为拥有一个庞大的企业帝国,你就可以利用自己庞大的资源,参加政治活动,甚至参加竞选活动。

当你一贫如洗时,每小时挣10美元会让你感觉是一个巨大的成就。同样地,如果你出生在中产阶级家庭,经营自己的企业会让你感觉那是一项巨大的成就。如果你是一个商人,经营一个庞大的企业帝国是你的梦想。因为拥有一个庞大的企业帝国,你就可以利用自己庞大的资源,参加政治活动,甚至参加竞选活动。

评论翻译

But what after that?

We live in times where governments have just started to be fair. Right now, the priority of most nations around the world is to lift their populace out of poverty while remaining sustainable and protecting the environment. You can see 3 problems to the rich right there i.e

Bring fairness

Grow in a sustainable way so that there are no critical shortages of resources like food, energy and water

Protect the environment so that humanity doesn’t go extinct

All 3 of these priorities cause modern governments to target the rich. This means, rich people are actively undermined by the sovereign nation-states that protect them.

As things stand today, if you are rich, you pay (at least in theory) until you are no longer rich.

但在那之后呢?

我们现在的社会是一个公平的社会。目前,世界上大多数国家的首要任务是帮助本国人民摆脱贫困,同时保持可持续发展和保护环境。富人目前面临三个问题:

保证公平原则;

以可持续的方式发展,以避免造成粮食、能源和水等资源的严重短缺;

保护环境,这样人类才不会灭绝

以上这3个问题导致现代政府将目标对准了富人。这意味着,即使那些保护富人利益的主权国家,现在也开始不断地削弱富人的影响力。

现在的情况是,如果你很富有,那么你就需要一直交税(至少在理论上),直到你不再富有。

where people who are outside Earth’s territorial control are kept from growing (through getting resources from mining asteroids) by Earth.

The point I’m trying to make is this.

As the state of human civilization stands right now, there are far too many forces working towards limiting the growth of the wealthy to let them last for more than 3 generations.

在电影中,地球之外的人被地球阻止成长,这些人通过采矿的小行星来获得资源。

我想说的是:

从人类文明目前的发展状况而言,有太多的力量在限制富人的增长,极力造成富不过三代的局面。

Biltmore, the family’s Gilded Age estate, is now a tourist attraction.

In 1810, future magnate "Commodore" Vanderbilt borrowed $100 from his mother and struck out as an entrepreneur. He found success in steamboats, then built an empire in railroads. By the time of his death, Vanderbilt's net worth exceeded that of the US Treasury! His son William Henry Vanderbilt inherited most of the family fortune and doubled it by the time of his death.

But that fateful third generation hit.

比尔特莫尔是该家族在镀金时代的地产。如今这个地方已成为著名的旅游胜地。1810年,未来的财富大亨范德比尔特从母亲那里借了100美元,开始创业。首先,他在蒸汽船方面取得了巨大的成功。之后,在铁路方面他又建立了自己的帝国。范德比尔特死的时候,他的私人净资产已经超过了美国的国库总量!他的儿子威廉·亨利·范德比尔特继承了大部分家族财产,并在他去世时将其财产增加了一倍。

但是第三代却仍然无法摆脱“富不过三代”的命运。

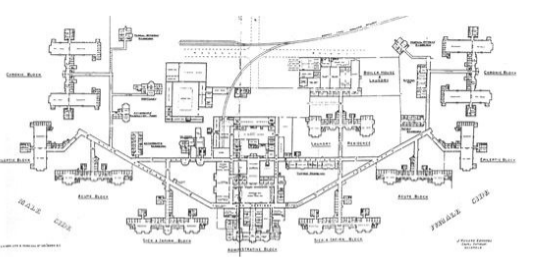

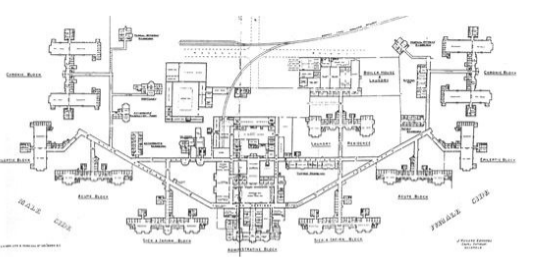

You are more than welcome to attempt and decipher this floor plan.

欢迎您来欣赏和解读这个平面图。

Hopefully this will give you a more simplified version of your answer and you will understand the indispensable value of proper education paralleled with experience. Often times too many parents wish to give their children a better life than what they had experienced, forgetting that it was this life which forged them into strong, smart and perceptive people.

希望这能给你一个更简化的答案,你将理解适当的教育与经验是相辅相成的,二者是不可或缺的。很多时候,太多的父母希望给他们的孩子一个更好的生活,却忘记了正是他们自己经历的这种生活将他们锻造成强大、聪明和有洞察力的人。

1.Divyanth Jayaraj

But if you are already part of a wealthy family, where do you go from there? You can’t buy yourself a kingdom. Your only options are to either join politics or stick to what you’re already doing; aka running that profitable corporate empire. Some people do switch to social causes, start trusts, fund research; even conduct their own.

但如果你已经是一个富裕家庭的一员,那么你又会做什么呢?你不能为自己买一个王国。你的选择只有两个,一是参加政治活动,走政治路线;二是坚持你已经在做的事情,继续运营企业帝国。当然,也有部分人转而从事社会事业,创办信托基金、基金研究等活动;甚至有部分人从零出发,自己开始创业。

But if you are already part of a wealthy family, where do you go from there? You can’t buy yourself a kingdom. Your only options are to either join politics or stick to what you’re already doing; aka running that profitable corporate empire. Some people do switch to social causes, start trusts, fund research; even conduct their own.

但如果你已经是一个富裕家庭的一员,那么你又会做什么呢?你不能为自己买一个王国。你的选择只有两个,一是参加政治活动,走政治路线;二是坚持你已经在做的事情,继续运营企业帝国。当然,也有部分人转而从事社会事业,创办信托基金、基金研究等活动;甚至有部分人从零出发,自己开始创业。

But what after that?

We live in times where governments have just started to be fair. Right now, the priority of most nations around the world is to lift their populace out of poverty while remaining sustainable and protecting the environment. You can see 3 problems to the rich right there i.e

Bring fairness

Grow in a sustainable way so that there are no critical shortages of resources like food, energy and water

Protect the environment so that humanity doesn’t go extinct

All 3 of these priorities cause modern governments to target the rich. This means, rich people are actively undermined by the sovereign nation-states that protect them.

As things stand today, if you are rich, you pay (at least in theory) until you are no longer rich.

但在那之后呢?

我们现在的社会是一个公平的社会。目前,世界上大多数国家的首要任务是帮助本国人民摆脱贫困,同时保持可持续发展和保护环境。富人目前面临三个问题:

保证公平原则;

以可持续的方式发展,以避免造成粮食、能源和水等资源的严重短缺;

保护环境,这样人类才不会灭绝

以上这3个问题导致现代政府将目标对准了富人。这意味着,即使那些保护富人利益的主权国家,现在也开始不断地削弱富人的影响力。

现在的情况是,如果你很富有,那么你就需要一直交税(至少在理论上),直到你不再富有。

If you have a high income, you get taxed. If your corporation gets too big, it gets broken up. If you break into new frontiers (say, build an island from scratch), other sovereign states (aka countries) will either claim what you build for themselves or pressure your own country to rein you in. This point is especially emphasized in the sci-fi TV show “The Expanse”

如果你有高收入,你要交税。如果你的公司不断扩张,那么它可能会破产。如果你开辟了新的边界(比如,从头开始建造一个岛屿),其他主权国家(又称国家)要么宣称你为自己建造的东西是他们的;要么给你的国家施加压力,让它约束你。科幻电视剧《苍穹浩瀚》特别强调了这一点。

如果你有高收入,你要交税。如果你的公司不断扩张,那么它可能会破产。如果你开辟了新的边界(比如,从头开始建造一个岛屿),其他主权国家(又称国家)要么宣称你为自己建造的东西是他们的;要么给你的国家施加压力,让它约束你。科幻电视剧《苍穹浩瀚》特别强调了这一点。

where people who are outside Earth’s territorial control are kept from growing (through getting resources from mining asteroids) by Earth.

The point I’m trying to make is this.

As the state of human civilization stands right now, there are far too many forces working towards limiting the growth of the wealthy to let them last for more than 3 generations.

在电影中,地球之外的人被地球阻止成长,这些人通过采矿的小行星来获得资源。

我想说的是:

从人类文明目前的发展状况而言,有太多的力量在限制富人的增长,极力造成富不过三代的局面。

A long time ago, it was due to lack of technological advancement. Now, it’s due to humanity’s need to fix the wounds of the past.

Meanwhile, wealth has been reaching more and more people than before; and that’s some good news to celebrate. Filthy rich families might not last for longer than 3 generations but upper-middle class families last for far more than three; and that’s something worth celebrating anyway.

很久以前,造成这种现象的原因是技术落后。而现在,造成这种现象的原因则是因为人类需要修复过去造成的创伤。与此同时,还是有一些值得庆祝的好消息,比如越来越多的人开始变得富有。巨富的家庭可能富不过三代,但中上阶层的家庭可以持续很多代。无论如何,这都是值得庆祝的。

Meanwhile, wealth has been reaching more and more people than before; and that’s some good news to celebrate. Filthy rich families might not last for longer than 3 generations but upper-middle class families last for far more than three; and that’s something worth celebrating anyway.

很久以前,造成这种现象的原因是技术落后。而现在,造成这种现象的原因则是因为人类需要修复过去造成的创伤。与此同时,还是有一些值得庆祝的好消息,比如越来越多的人开始变得富有。巨富的家庭可能富不过三代,但中上阶层的家庭可以持续很多代。无论如何,这都是值得庆祝的。

2.John Roberson, Stock Trader

Originally Answered: Why does family wealth rarely last more than 3 generations?

Cornelius Vanderbilt was the richest man in America. His son doubled his fortune. Yet even his wealthiest descendant of our generation, Anderson Cooper, received no inheritance. What happened?

康奈利·范德比尔特是美国最富有的人。到他儿子的时代时,家族的财产翻了一番。然而,即使如此,最富有的后裔安德森·库珀却没有继承任何遗产,这中间发生了什么事呢?

Originally Answered: Why does family wealth rarely last more than 3 generations?

Cornelius Vanderbilt was the richest man in America. His son doubled his fortune. Yet even his wealthiest descendant of our generation, Anderson Cooper, received no inheritance. What happened?

康奈利·范德比尔特是美国最富有的人。到他儿子的时代时,家族的财产翻了一番。然而,即使如此,最富有的后裔安德森·库珀却没有继承任何遗产,这中间发生了什么事呢?

Biltmore, the family’s Gilded Age estate, is now a tourist attraction.

In 1810, future magnate "Commodore" Vanderbilt borrowed $100 from his mother and struck out as an entrepreneur. He found success in steamboats, then built an empire in railroads. By the time of his death, Vanderbilt's net worth exceeded that of the US Treasury! His son William Henry Vanderbilt inherited most of the family fortune and doubled it by the time of his death.

But that fateful third generation hit.

比尔特莫尔是该家族在镀金时代的地产。如今这个地方已成为著名的旅游胜地。1810年,未来的财富大亨范德比尔特从母亲那里借了100美元,开始创业。首先,他在蒸汽船方面取得了巨大的成功。之后,在铁路方面他又建立了自己的帝国。范德比尔特死的时候,他的私人净资产已经超过了美国的国库总量!他的儿子威廉·亨利·范德比尔特继承了大部分家族财产,并在他去世时将其财产增加了一倍。

但是第三代却仍然无法摆脱“富不过三代”的命运。

The money was split between two of the Commodore's grandsons: Cornelius Vanderbilt II and William Kissam Vanderbilt. The latter noted, "Inherited wealth is a real handicap to happiness... It has left me with nothing to hope for, with nothing definite to seek or strive for.

财产由范德比尔特的两个孙子继承:科尼利乌斯·范德比尔特二世和威廉·范德比尔特基。威廉指出:“继承的财富是获得幸福的真正障碍,它让我失去了希望,没有明确的追求和奋斗目标。”

财产由范德比尔特的两个孙子继承:科尼利乌斯·范德比尔特二世和威廉·范德比尔特基。威廉指出:“继承的财富是获得幸福的真正障碍,它让我失去了希望,没有明确的追求和奋斗目标。”

Houses, parties, sport, philanthropy — these came to dominate all heirs' interests. And as railroads declined in significance, there was no one left to marshal the Vanderbilts' considerable resources and connections to secure a bright future for the family's railroad-based fortune.

房子、聚会、运动、慈善事业——这些成了所有继承人的主要内容。随着铁路行业的不景气,范德比尔特家族没有人可以调动他们的大量资源和人脉,为家族财富创造一个光明的未来。

房子、聚会、运动、慈善事业——这些成了所有继承人的主要内容。随着铁路行业的不景气,范德比尔特家族没有人可以调动他们的大量资源和人脉,为家族财富创造一个光明的未来。

In the mid-20th century, the great Vanderbilt houses were torn down, and while their name lives on at Vanderbilt University, the influence and prominence of the family itself has fallen out of sight almost entirely.

20世纪中期,著名的范德比尔特房被拆除。虽然范德比尔特这个名字仍在范德比尔特大学流传,但家族本身的影响力和声望却几乎已经完全消失了。

20世纪中期,著名的范德比尔特房被拆除。虽然范德比尔特这个名字仍在范德比尔特大学流传,但家族本身的影响力和声望却几乎已经完全消失了。

I've not dealt with family money of near the magnitude of the Vanderbilts — their fortune would be greatest in the world today, after all. But I have spent time with those with substantial family money. In my experience, there are two broad ways of setting priorities within the family legacy.

虽然,范德比尔特家族的财富是当今世界上最大的,但我却没有和这个家族打过交道。但是,我也曾经与那些家里有钱的人在一起交流过,所以,根据我的经验,有两种宽泛的方式来确定家族遗产的优先顺序。

虽然,范德比尔特家族的财富是当今世界上最大的,但我却没有和这个家族打过交道。但是,我也曾经与那些家里有钱的人在一起交流过,所以,根据我的经验,有两种宽泛的方式来确定家族遗产的优先顺序。

Wealthy Families: A brilliant plan is structured to transfer the family’s fortune in the financially optimal way. Estate taxes, private business interests, capital gains — all in the plan. The kids are filthy rich. So are the grandkids. But the soul of the family erodes, and so does the family fortune.

富有的家庭:制定一个聪明的计划,按照最优的方式转移家族财富。遗产税、私人企业权益、资本利得等都在计划之中。这些家庭的孩子都非常有钱,孙子辈也是如此。但是,一旦家族的灵魂被侵蚀了,那么家族的财富也就被侵蚀了。

富有的家庭:制定一个聪明的计划,按照最优的方式转移家族财富。遗产税、私人企业权益、资本利得等都在计划之中。这些家庭的孩子都非常有钱,孙子辈也是如此。但是,一旦家族的灵魂被侵蚀了,那么家族的财富也就被侵蚀了。

Wealthy Families: These families are not passing on money, they’re passing on a family culture. The family fortune is one tool entrusted to the family, and so they do want a great financial plan. But the fundamental legacy they’ve built is an institution, a culture — a family.

富裕家庭:这些家庭并不是在传递金钱,而是在传递一种家庭文化。家族财富只是一种委托给家族的工具,所以他们需要制定一个伟大的财务计划。但他们建立的基本遗产是一种制度、一种文化,甚至是一个家庭。

富裕家庭:这些家庭并不是在传递金钱,而是在传递一种家庭文化。家族财富只是一种委托给家族的工具,所以他们需要制定一个伟大的财务计划。但他们建立的基本遗产是一种制度、一种文化,甚至是一个家庭。

The number one financial error people make is to mistake money for wealth.

Are you working to build a family or a checking account?

人们最常犯的错误就是把钱误认为财富。

你工作是为了建立一个家庭还是一个支票账户?

Are you working to build a family or a checking account?

人们最常犯的错误就是把钱误认为财富。

你工作是为了建立一个家庭还是一个支票账户?

3.Anonymous

Originally Answered: Why do wealthy families hardly last more for three generations?

I’m the third generation of a wealthy family and have a huge trust fund because my father and his brother are fantastic investors and invested my trust well. I also worked for 20 years at a well paid professional job and got a STEM graduate degree while they invested my trust and the money grew 10x. I can live a luxurious life for the rest of my adult life without working, but I look at the money I have as a legacy of two generations of hard work by my father and grandfather and feel that I have to respect that legacy. In my grandiose fantasies I imagine how I could 10x the money I have and join the private jet crowd. The only reason it would be worth it though would be to receive the kind of prestige that my father and grandfather attained among their peers.

我是一个富裕家庭的第三代传人,拥有一个巨大的信托基金。因为我的父亲和他的兄弟都是出色的投资者,他们给我投资了一个很好的信托基金。我现在有一份高薪的工作,并且已经工作了20年。而且我还取得了STEM研究生学位。我父亲和叔叔的投资现在已经增长了10倍。我完全可以在我的成年生活中无需工作,过着奢侈的生活。但是我看着我的父亲和祖父两代人辛勤工作留下的遗产,我觉得我必须尊重这些遗产。有时我也会陷入浮夸的幻想中,我想象自己把手头的资产翻了十倍,然后成功的变成超级富豪,加入到拥有私人飞机的人群中。这样做的唯一原因是可以获得威望,获得我父亲和祖父在同龄人中的那种威望。

Originally Answered: Why do wealthy families hardly last more for three generations?

I’m the third generation of a wealthy family and have a huge trust fund because my father and his brother are fantastic investors and invested my trust well. I also worked for 20 years at a well paid professional job and got a STEM graduate degree while they invested my trust and the money grew 10x. I can live a luxurious life for the rest of my adult life without working, but I look at the money I have as a legacy of two generations of hard work by my father and grandfather and feel that I have to respect that legacy. In my grandiose fantasies I imagine how I could 10x the money I have and join the private jet crowd. The only reason it would be worth it though would be to receive the kind of prestige that my father and grandfather attained among their peers.

我是一个富裕家庭的第三代传人,拥有一个巨大的信托基金。因为我的父亲和他的兄弟都是出色的投资者,他们给我投资了一个很好的信托基金。我现在有一份高薪的工作,并且已经工作了20年。而且我还取得了STEM研究生学位。我父亲和叔叔的投资现在已经增长了10倍。我完全可以在我的成年生活中无需工作,过着奢侈的生活。但是我看着我的父亲和祖父两代人辛勤工作留下的遗产,我觉得我必须尊重这些遗产。有时我也会陷入浮夸的幻想中,我想象自己把手头的资产翻了十倍,然后成功的变成超级富豪,加入到拥有私人飞机的人群中。这样做的唯一原因是可以获得威望,获得我父亲和祖父在同龄人中的那种威望。

I invest fairly conservatively these days. I don’t spend more than I earn passively, and I will probably have some rich heirs the way things are going. I guess that means 4 generations of wealth. I am not as good of an investor as my father or his father so I don’t take big risks. I’m all set to do fine though. If I didn’t have that trust fund, I’d be a middle class working person stuck semi-permanently in the rat race like the fellow professionals I worked with during my working years. I lived on that budget for a long time, and there were some lean years where I was living in apartments and would almost run out of money at the end of the month, so I feel massively fortunate to have money.

我现在的投资相当保守。我的消费观念是坚决杜绝入不敷出,所以按照这种方式,我肯定会给我的继承人留下很多资产,这意味着4代人的财富积累。我不像我的父亲和我的爷爷那样善于投资,所以我不会冒太大的风险。不过我已经准备好了。如果我没有那笔信托基金,我就会成为一个中产阶级的上班族。就像与我共事的那些专业人士一样,永久地陷入“老鼠赛跑”的奋斗状态。曾经有很长一段时间,我都是靠这个预算生活的。有那么几年,我住在公寓里,每到月底钱就快花光了,所以我觉得有钱是一件非常幸运的事。

我现在的投资相当保守。我的消费观念是坚决杜绝入不敷出,所以按照这种方式,我肯定会给我的继承人留下很多资产,这意味着4代人的财富积累。我不像我的父亲和我的爷爷那样善于投资,所以我不会冒太大的风险。不过我已经准备好了。如果我没有那笔信托基金,我就会成为一个中产阶级的上班族。就像与我共事的那些专业人士一样,永久地陷入“老鼠赛跑”的奋斗状态。曾经有很长一段时间,我都是靠这个预算生活的。有那么几年,我住在公寓里,每到月底钱就快花光了,所以我觉得有钱是一件非常幸运的事。

I have some trust fund friends from childhood who aren’t doing so well. The main problem with these friends are:Not forced to make a living when they were younger. This eventually ends with them becoming delusional artists. They go into the music business and they are mediocre at it and there isn’t much money in music these days. They make art and try and sell it and do pretty badly. They try and stock trade and are mediocre at it. If rich parents are wise they will keep their kids on a small allowance and force them to work at something.

我有一些儿时朋友,他们也有信托基金,但是他们做得并不好。主要问题是以下几个方面:年轻的时候没有被迫谋生过,这导致他们成为了妄想的艺术家。他们进入了音乐行业,但却表现平平,而且现在音乐行业并没有多少钱。他们不断创作艺术品,然后尝试卖掉它,结果他们却做得很糟糕。他们也曾尝试着进行股票交易,但仍然表现平平。那些明智的富豪父母,他们只会给自己的孩子少量的零用钱,并让他们去做一些力所能及的事情。

我有一些儿时朋友,他们也有信托基金,但是他们做得并不好。主要问题是以下几个方面:年轻的时候没有被迫谋生过,这导致他们成为了妄想的艺术家。他们进入了音乐行业,但却表现平平,而且现在音乐行业并没有多少钱。他们不断创作艺术品,然后尝试卖掉它,结果他们却做得很糟糕。他们也曾尝试着进行股票交易,但仍然表现平平。那些明智的富豪父母,他们只会给自己的孩子少量的零用钱,并让他们去做一些力所能及的事情。

Drugs. Lots of drugs. Seems the boredom of not really being exceptionally good at anything makes people smoke pot. Pot makes people happy with not doing anything with their life. Excessive drinking is also a well travelled downhill path to being a complete failure at life. One huge train wreck of a trust fund kid seriously damaged her health with harder drugs and now has persistent medical problems. Mental health problems usually follow a lot of drug experimentation.

2.禁品。生活中有太多的禁品。对任何事情都没有兴趣,无趣的生活驱使他们开始食用这些禁品。禁品让他们无所事事的生活充满乐趣,让他们感到快乐。酗酒也让他们的生活变的彻底失败。一个信托基金的孩子遭遇了火车的巨大事故,这严重损害了她的健康,因此她需要服用更多的禁品,现在她有一系列的医疗健康问题。心理健康问题也通常是由大量的药物引起的。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

2.禁品。生活中有太多的禁品。对任何事情都没有兴趣,无趣的生活驱使他们开始食用这些禁品。禁品让他们无所事事的生活充满乐趣,让他们感到快乐。酗酒也让他们的生活变的彻底失败。一个信托基金的孩子遭遇了火车的巨大事故,这严重损害了她的健康,因此她需要服用更多的禁品,现在她有一系列的医疗健康问题。心理健康问题也通常是由大量的药物引起的。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

Not taking advantage of the wealth of experience of their elders. I went to a kids business summer camp when I was little and because I was interested in business and my dad and I talked a lot about it, I knew far more than the other kids. The rest of my trust fund friends who thought their parents were materialistic and did not take an interest in business eventually went the route of middle class mediocrity and taught it to their kids. Having a highly successful business person who is willing to mentor you for an extended period of time is a huge advantage that a lot of the third generation just throw away. The second generation usually grew up poorer so they know what poverty is like and try to learn as much as possible from their parents.

没有充分利用长辈的丰富经验。我小时候参加过一个儿童商业夏令营,因为我对商业很感兴趣,我爸爸和我谈了很多,所以我知道的比其他孩子要多得多。我有一些信托基金朋友,他们认为他们的父母是物质主义者,这导致他们对商业不感兴趣,最终走上了中产阶级的平庸之路,然后这一想法也传给了他们的孩子。一个非常成功的商人愿意长期指导你,这是一个巨大的优势,但是很多第三代人却把这个优势丢掉了。第二代人通常是在贫困中长大的,所以他们知道贫穷是什么样子,并从父母那里学到了很多。

没有充分利用长辈的丰富经验。我小时候参加过一个儿童商业夏令营,因为我对商业很感兴趣,我爸爸和我谈了很多,所以我知道的比其他孩子要多得多。我有一些信托基金朋友,他们认为他们的父母是物质主义者,这导致他们对商业不感兴趣,最终走上了中产阶级的平庸之路,然后这一想法也传给了他们的孩子。一个非常成功的商人愿意长期指导你,这是一个巨大的优势,但是很多第三代人却把这个优势丢掉了。第二代人通常是在贫困中长大的,所以他们知道贫穷是什么样子,并从父母那里学到了很多。

4. Ahmed N. Muneeb, 7 Years Experience Managing Wealth

Full Disclosure: I spent the last 7 years in the financial services industry, more specifically within the wealth management arena.

Over the last 7 years, I moved up the wealth management spectrum and went from the brokerage world (think of the Merrill Lynch's of the world), to the holistic financial planning niche, to the private banks and ultimately within the family office space. 70% of wealth is lost when transferred from the wealth creating generation to the next, and 90% is lost after that!

The data is sobering.

Estate planning is a major family office practice, yet a more underrated aspect of wealth planning. Investment planning and portfolio management often receive the glitz and glamour in the wealth management arena. However, family governance and education is fundamental to ensuring wealth is maintained and grown through each generation.

全面披露:我在金融服务行业工作了7年,更确切地说,是在财富管理领域。在过去的7年里,我在财富管理领域不断发展,首先从经纪行业(美林的世界),到整体金融规划领域,再到私人银行,最终进入家族理财领域。财富从创造财富的一代转移到下一代的过程中,大约会损失70%,在那之后将会损失90% !这些数据如此的发人深省。遗产规划是家族理财的一项重要业务,但也是财富规划中最容易被低估的一个方面。在财富管理领域,投资规划和投资组合管理常常备受瞩目。然而,家庭管理和教育才是确保财富在每一代得到维持和增长的基础。

Full Disclosure: I spent the last 7 years in the financial services industry, more specifically within the wealth management arena.

Over the last 7 years, I moved up the wealth management spectrum and went from the brokerage world (think of the Merrill Lynch's of the world), to the holistic financial planning niche, to the private banks and ultimately within the family office space. 70% of wealth is lost when transferred from the wealth creating generation to the next, and 90% is lost after that!

The data is sobering.

Estate planning is a major family office practice, yet a more underrated aspect of wealth planning. Investment planning and portfolio management often receive the glitz and glamour in the wealth management arena. However, family governance and education is fundamental to ensuring wealth is maintained and grown through each generation.

全面披露:我在金融服务行业工作了7年,更确切地说,是在财富管理领域。在过去的7年里,我在财富管理领域不断发展,首先从经纪行业(美林的世界),到整体金融规划领域,再到私人银行,最终进入家族理财领域。财富从创造财富的一代转移到下一代的过程中,大约会损失70%,在那之后将会损失90% !这些数据如此的发人深省。遗产规划是家族理财的一项重要业务,但也是财富规划中最容易被低估的一个方面。在财富管理领域,投资规划和投资组合管理常常备受瞩目。然而,家庭管理和教育才是确保财富在每一代得到维持和增长的基础。

Proper estate planning also correlates with this discipline to execute, but it all starts with education.Here are a few reasons for why 90% of wealth is lost by the third generation:

Family Structure. This practice is known as family governance, which is establishing the proper frxwork for the wealth creators’ families and especially offspring to assume that responsibility as well as making sound financial decisions. It comes down to governing the family business and family practices (i.e. having quarterly family meetings and annual retreats to discuss family ventures). Having worked in the industry over 7 years, many families have found success with educating their offspring from as young as 10 years old about financial fundamentals and building those positive habits early on.

合适的财产规划需要相关联的执行流程,但这一切都始于教育。

以下是第三代富人会失去90%的财富的几个原因:

家庭结构。这种做法被称为“家族治理”,它为财富创造者的家庭,特别是后代建立了适当的框架,以便他们承担起责任,并做出合理的财务决策。它可以归结为管理家族企业和家族惯例(即每季度召开一次家庭会议,每年举行一次休养会,讨论家族企业)。在这个行业工作了7年以上的许多家庭发现,从孩子10岁起就教会他们财务基础知识,并在孩子很小的时候就养成这些积极的习惯是成功的。

Family Structure. This practice is known as family governance, which is establishing the proper frxwork for the wealth creators’ families and especially offspring to assume that responsibility as well as making sound financial decisions. It comes down to governing the family business and family practices (i.e. having quarterly family meetings and annual retreats to discuss family ventures). Having worked in the industry over 7 years, many families have found success with educating their offspring from as young as 10 years old about financial fundamentals and building those positive habits early on.

合适的财产规划需要相关联的执行流程,但这一切都始于教育。

以下是第三代富人会失去90%的财富的几个原因:

家庭结构。这种做法被称为“家族治理”,它为财富创造者的家庭,特别是后代建立了适当的框架,以便他们承担起责任,并做出合理的财务决策。它可以归结为管理家族企业和家族惯例(即每季度召开一次家庭会议,每年举行一次休养会,讨论家族企业)。在这个行业工作了7年以上的许多家庭发现,从孩子10岁起就教会他们财务基础知识,并在孩子很小的时候就养成这些积极的习惯是成功的。

Education. Poor decisions stem from poor financial education and with more wealth is to have more responsibility. With vast amounts of wealth, there are a multitude of investment and financial planning vehicles available to wealthy families that a regular salaried family will not have. Understanding the different types is especially emphasized in the trust and estate planning niche.

教育。糟糕的决定源于糟糕的教育,财富越多,责任就越大。拥有巨额财富的富裕家庭拥有大量的投资和理财工具,而这些是普通工薪家庭所没有的。在信托和遗产规划机构内部,区分不同的家庭类型是非常重要的。

教育。糟糕的决定源于糟糕的教育,财富越多,责任就越大。拥有巨额财富的富裕家庭拥有大量的投资和理财工具,而这些是普通工薪家庭所没有的。在信托和遗产规划机构内部,区分不同的家庭类型是非常重要的。

Entitlement. Ah yes, the trust-fund baby jokes, once again. With all of these other factors, maintaining wealth is just as difficult as creating it. Wealth creators who have established efficient trust & estate planning practices have created trusts for their children and grandchildren holding six-figures in each of those trusts. Climbing up the socioeconomic ladder involves drive, motivation, mission and ambition and when offspring inherits that wealth that drive could be missing since the security blanket is already established. At the core of it all, starts with establishing the proper family frxwork, mission, governance and education before any sort of planning begins.

权利。是的,这只是信托基金的惯用伎俩。考虑到所有这些因素,保持财富和创造财富一样困难。那些建立了高效信托和财产规划实践的财富创造者,为他们的子女和孙辈建立了信托,每个信托都持有六位数的股份。在社会经济阶梯上往上爬,需要动力、动机、使命和抱负,而当子女继承了这些财富后,这种动力可能就会消失,因为已经建立了足够的安全感。总之最核.心的是,在任何计划开始之前,首先要建立适当的家庭框架、使命、管理和教育。

权利。是的,这只是信托基金的惯用伎俩。考虑到所有这些因素,保持财富和创造财富一样困难。那些建立了高效信托和财产规划实践的财富创造者,为他们的子女和孙辈建立了信托,每个信托都持有六位数的股份。在社会经济阶梯上往上爬,需要动力、动机、使命和抱负,而当子女继承了这些财富后,这种动力可能就会消失,因为已经建立了足够的安全感。总之最核.心的是,在任何计划开始之前,首先要建立适当的家庭框架、使命、管理和教育。

5. Geoff Gilleland, Read science half my life and I make connections

Originally Answered: Why does family wealth rarely last more than 3 generations?

This saying is just no longer as true.

It previously was simple dilution (from having more kids than the relative growth of that adult generation total net worth) and the government taking 80% in taxes in 2 generations.

With trusts and estate planning now making inheritance tax optional, with modern economies making the wealthy get double the return on equity compared to investments of the non-wealthy, and with smaller family sizes, it just doesn't have to happen anymore.

这句话并不适用于现在的社会。在此之前,它只是非常简单的过程(因为孩子数量的增长超过了成年后总资产的增长),并且政府在两代人的时间里可以获得80%的税收。如今,信托和遗产规划让遗产税成为了一种可选择的选项,现代经济中,富人获得的股本回报率比非富人的投资高出一倍,而且富人的家庭规模也在缩小,所以遗产税就没有征收的必要了。

Originally Answered: Why does family wealth rarely last more than 3 generations?

This saying is just no longer as true.

It previously was simple dilution (from having more kids than the relative growth of that adult generation total net worth) and the government taking 80% in taxes in 2 generations.

With trusts and estate planning now making inheritance tax optional, with modern economies making the wealthy get double the return on equity compared to investments of the non-wealthy, and with smaller family sizes, it just doesn't have to happen anymore.

这句话并不适用于现在的社会。在此之前,它只是非常简单的过程(因为孩子数量的增长超过了成年后总资产的增长),并且政府在两代人的时间里可以获得80%的税收。如今,信托和遗产规划让遗产税成为了一种可选择的选项,现代经济中,富人获得的股本回报率比非富人的投资高出一倍,而且富人的家庭规模也在缩小,所以遗产税就没有征收的必要了。

At some point a nest egg grows larger and faster than you can spend the annual return (at some size this works even with treasury bonds). It would take huge waste (and/or mistakes) to lose an inheritance.It's like why do all the professional ballplayers end up broke; that does not happen anymore now that there is a system of professionals in place to help them handle their money without getting ripped off or letting them out spend it. Also their child does not need to know the family business in order to maintain wealth now, with today's system.

在某种程度上,你的储蓄比你的年收益增长得更快更大(在某种程度上,这甚至适用于国债)。失去一份遗产会造成巨大的浪费。就像为什么所有的职业棒球运动员最后都破产了。现在这种情况已经不再发生了,因为有了一个专业系统,可以帮助他们处理自己的钱,从而避免他们随意花掉自己所有的钱财。在今天的制度下,富人的孩子也不需要为了维持家族的财富,而被迫了解和熟悉家族生意。

在某种程度上,你的储蓄比你的年收益增长得更快更大(在某种程度上,这甚至适用于国债)。失去一份遗产会造成巨大的浪费。就像为什么所有的职业棒球运动员最后都破产了。现在这种情况已经不再发生了,因为有了一个专业系统,可以帮助他们处理自己的钱,从而避免他们随意花掉自己所有的钱财。在今天的制度下,富人的孩子也不需要为了维持家族的财富,而被迫了解和熟悉家族生意。

If you're so rich you don't have to work, you may not have the personality to acquire the business set needed grow your nest egg enough to live on it yourself and split it to two offspring, or certainly not three times. So yes, there are limits with the definition of wealthy where you are not going to stay 3 generations in that definition at the extremes (mega rich won't stay mega rich and mildly wealthy won't stay wealthy as they have to touch the principle to live “a rich lifestyle”, which some brat will want).

如果你很富有,那么你不需要工作。你可能没有足够的能力去维持所有的业务,从而使你的储蓄资金足够养活自己,并且可以将其留给两个子女,或者留给第三代。是的,对富有的定义是有限度的,在这个极端的定义下,你不能只停留在第三代这一方面(超级富豪不会一直是超级富豪,一般富豪也不会一直是富豪,因为他们必须触及“富裕生活方式”的原则,而这正是一些孩子想要的)。

如果你很富有,那么你不需要工作。你可能没有足够的能力去维持所有的业务,从而使你的储蓄资金足够养活自己,并且可以将其留给两个子女,或者留给第三代。是的,对富有的定义是有限度的,在这个极端的定义下,你不能只停留在第三代这一方面(超级富豪不会一直是超级富豪,一般富豪也不会一直是富豪,因为他们必须触及“富裕生活方式”的原则,而这正是一些孩子想要的)。

The difference here is middle class definitions versus the wealthy old upper-class definition. Primogeniture worked to maintain family estates, and in fact many got way past 3 generations. That was unAmerican, and 3 smart offspring in a row was not expected, but real wealth could be maintained. One of the Vanderbilt offspring still owns the largest house in the country, the Biltmore estate, and it is making tons of money for their current generation. Even Paris Hilton couldn't outspend her current acquired assets. If she doesn't give it to charity or have too many children, then her grandchildren's grandchildren will live her life style. Put it in a trust with standard limits, and it's a given nowadays. The new normal is that the wealthy will stay wealthy.

这里的区别是中产阶级的定义和富有的上层阶级的定义。长子继承制有助于维持家族遗产,事实上又很多人继承了三代以上的遗产。这是不符合美国人的理念的,而且连续拥有3个聪明的后代也不是意料之中的,但真正的财富是可以维持的。范德比尔特的一个后代仍然拥有美国最大的房产——比尔特莫尔庄园,这个庄园为他们这一代赚了大量的钱。就连帕丽斯·希尔顿的花费也无法超过她目前获得的资产。如果她不把钱捐给慈善机构,或者生了太多的孩子,那么她孙子的孙辈也一样会过她那种生活。把资产放在一个有标准限制的信托中,这在现代是一种常态。新的财富状态就是,富人将继续维持富有的生活。

这里的区别是中产阶级的定义和富有的上层阶级的定义。长子继承制有助于维持家族遗产,事实上又很多人继承了三代以上的遗产。这是不符合美国人的理念的,而且连续拥有3个聪明的后代也不是意料之中的,但真正的财富是可以维持的。范德比尔特的一个后代仍然拥有美国最大的房产——比尔特莫尔庄园,这个庄园为他们这一代赚了大量的钱。就连帕丽斯·希尔顿的花费也无法超过她目前获得的资产。如果她不把钱捐给慈善机构,或者生了太多的孩子,那么她孙子的孙辈也一样会过她那种生活。把资产放在一个有标准限制的信托中,这在现代是一种常态。新的财富状态就是,富人将继续维持富有的生活。

6. Rayan Zehana

The common reason for this is actually due to the shared traits that Entrepreneurs and self-made men possess, everybody starts from somewhere, right? Typically, the founders of a family’s fortune are usually the most intelligent, perceptive and open-minded of the family, the best way to secure the legacy and wealth of a family is to give experience to family members and educate them. There have been too many families that have lost their wealth due to the ignorance of a few reckless heirs. The most successful families, (labeling the Rothschilds in this example) are typically the most stable and successive, one can only assume the strict, rigorous education that each family member must go through in order to persevere and retain the family’s vast success and fortune.

造成这种现象有一个常见的原因,就是由于企业家和白手起家者拥有的共同特征,每个人都是从某个地方开始的。一般来说,家族财富的创始人通常是家族中最聪明、最有洞察力、思想最开放的人,确保家族遗产和财富的最好方式就是向家族成员传授经验并教育他们。有太多的家庭因为几个鲁莽的继承人的无知而失去了他们的财富。最成功的家庭(在这个例子中被称为罗斯柴尔德家族)通常是最稳定、最成功的。我们只能假定每个家庭成员必须接受严格、严谨的教育,才能维持和保留家族的巨大成功和财富。

The common reason for this is actually due to the shared traits that Entrepreneurs and self-made men possess, everybody starts from somewhere, right? Typically, the founders of a family’s fortune are usually the most intelligent, perceptive and open-minded of the family, the best way to secure the legacy and wealth of a family is to give experience to family members and educate them. There have been too many families that have lost their wealth due to the ignorance of a few reckless heirs. The most successful families, (labeling the Rothschilds in this example) are typically the most stable and successive, one can only assume the strict, rigorous education that each family member must go through in order to persevere and retain the family’s vast success and fortune.

造成这种现象有一个常见的原因,就是由于企业家和白手起家者拥有的共同特征,每个人都是从某个地方开始的。一般来说,家族财富的创始人通常是家族中最聪明、最有洞察力、思想最开放的人,确保家族遗产和财富的最好方式就是向家族成员传授经验并教育他们。有太多的家庭因为几个鲁莽的继承人的无知而失去了他们的财富。最成功的家庭(在这个例子中被称为罗斯柴尔德家族)通常是最稳定、最成功的。我们只能假定每个家庭成员必须接受严格、严谨的教育,才能维持和保留家族的巨大成功和财富。

One good example would be the fortune of the Winchester Family, famous for the aptly named Winchester rifle, the family patriarch, William Wirt Winchester would die in the year 1881 from Tuberculosis, upon his death he was childless, and his widow Sarah Winchester would inherit the fortune of $20 million (equivalent to over $500 million today.) A grieving widow of her husband and her deceased daughter, she would spend most if not all the family fortune on the construction of the Winchester Mansion, which, under the duress that she was haunted, she would continually add more rooms to the house which would make no sense,

温彻斯特家族的财富就是一个很好的例子,该家族的族长以其名符其实的“温彻斯特步枪”而闻名。1881年,家族元老威廉·温彻斯特死于肺结核。因为它生平没有孩子,所以他的遗孀莎拉·温彻斯特将继承2000万美元的财产(相当于今天的5亿多美元)。作为她丈夫的遗孀,她把大部分的家庭财产都花在建造温彻斯特大宅邸上。在被纠缠的压力下,她不断地在房子里增加更多的房间,而这毫无意义。

温彻斯特家族的财富就是一个很好的例子,该家族的族长以其名符其实的“温彻斯特步枪”而闻名。1881年,家族元老威廉·温彻斯特死于肺结核。因为它生平没有孩子,所以他的遗孀莎拉·温彻斯特将继承2000万美元的财产(相当于今天的5亿多美元)。作为她丈夫的遗孀,她把大部分的家庭财产都花在建造温彻斯特大宅邸上。在被纠缠的压力下,她不断地在房子里增加更多的房间,而这毫无意义。

Staircases which lead to empty wall, doors which open to a balcony which wasn’t there, the Winchester Mystery House is a popular attraction for visitors and tourists, largely due to the fact that it was built by a widow with staggering amounts of wealth, all of which was presumably lost to time.

通向空墙的楼梯,通向原本不存在的阳台的门,这都是温彻斯特神秘屋的热门景点。这座府邸是由一位拥有惊人财富的寡妇建造的,这一切大概都被时间遗忘了。

通向空墙的楼梯,通向原本不存在的阳台的门,这都是温彻斯特神秘屋的热门景点。这座府邸是由一位拥有惊人财富的寡妇建造的,这一切大概都被时间遗忘了。

You are more than welcome to attempt and decipher this floor plan.

欢迎您来欣赏和解读这个平面图。

Hopefully this will give you a more simplified version of your answer and you will understand the indispensable value of proper education paralleled with experience. Often times too many parents wish to give their children a better life than what they had experienced, forgetting that it was this life which forged them into strong, smart and perceptive people.

希望这能给你一个更简化的答案,你将理解适当的教育与经验是相辅相成的,二者是不可或缺的。很多时候,太多的父母希望给他们的孩子一个更好的生活,却忘记了正是他们自己经历的这种生活将他们锻造成强大、聪明和有洞察力的人。

7. Mehran Jalali, studied at National Organization for Development of Exceptional Talents (2020)

upxed February 4, 2017 · Upvoted by Bert Morris, Retired CFO and Franklin Parker, works with very wealthy families

Originally Answered: Why does family wealth rarely last more than 3 generations?

My history teacher has a great explanation for this.

See, the first person to become rich in the family wasn’t born into wealth. The person worked and struggled to become rich. For that reason, he (let’s assume it’s a male) knows the value of money. His son, the second generation was also probably not born into wealth. He was likely born when his father was struggling to make money, and for that reason, he knows the value of money. If he was born into wealth however, then the money is likely doomed. He will probably spend recklessly, as he didn’t work for the money, and doesn’t know the value of it.

我的历史老师对此有很好的见解。家里第一个变得富有的人并不是生下来就富有的。这个人努力工作,努力致富。出于这个原因,他(我们假设他是男性)才更了解金钱的价值。他的儿子,第二代可能还没有出生就已经很富贵了。他可能是在他父亲努力赚钱的时候出生的,因此,他也知道金钱的价值。然而,如果他出生在一个富有的家庭,那么这笔钱很可能注定会被败光。他可能会不顾一切地花钱,因为他不是为了钱而工作,也并不知道钱的价值。

upxed February 4, 2017 · Upvoted by Bert Morris, Retired CFO and Franklin Parker, works with very wealthy families

Originally Answered: Why does family wealth rarely last more than 3 generations?

My history teacher has a great explanation for this.

See, the first person to become rich in the family wasn’t born into wealth. The person worked and struggled to become rich. For that reason, he (let’s assume it’s a male) knows the value of money. His son, the second generation was also probably not born into wealth. He was likely born when his father was struggling to make money, and for that reason, he knows the value of money. If he was born into wealth however, then the money is likely doomed. He will probably spend recklessly, as he didn’t work for the money, and doesn’t know the value of it.

我的历史老师对此有很好的见解。家里第一个变得富有的人并不是生下来就富有的。这个人努力工作,努力致富。出于这个原因,他(我们假设他是男性)才更了解金钱的价值。他的儿子,第二代可能还没有出生就已经很富贵了。他可能是在他父亲努力赚钱的时候出生的,因此,他也知道金钱的价值。然而,如果他出生在一个富有的家庭,那么这笔钱很可能注定会被败光。他可能会不顾一切地花钱,因为他不是为了钱而工作,也并不知道钱的价值。

The chances that the third generation was not born into wealth is extremely slim. I mean, the first generation likely didn’t have grandchildren before becoming wealthy. Since the third generation didn’t work for their wealth, they wouldn't know the value of money, and waste it. Of course, my history teacher wasn’t talking about wealth. He was talking about how Persian dynasties usually didn’t last more than 2–3 generations.It was an extremely insightful explanation for me, so I thought I should share it here. I hope you enjoyed it.

第三代不是出生在富裕家庭的可能性极小。我的意思是,第一代在变得富有之前可能并没有孙辈。因为第三代人不为他们的财富工作,他们不知道钱的价值,所以他们肆无忌惮的消费了它。当然,我的历史老师说的不是财富。他说的是波斯王朝通常不会持续超过2-3代。这对我来说是一个非常深刻的解释,所以我想我应该在这里分享它。希望你喜欢。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

第三代不是出生在富裕家庭的可能性极小。我的意思是,第一代在变得富有之前可能并没有孙辈。因为第三代人不为他们的财富工作,他们不知道钱的价值,所以他们肆无忌惮的消费了它。当然,我的历史老师说的不是财富。他说的是波斯王朝通常不会持续超过2-3代。这对我来说是一个非常深刻的解释,所以我想我应该在这里分享它。希望你喜欢。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

很赞 0

收藏